From Gold to Code

A first-principles look at the history of money and why Bitcoin is a possible ally for proponents of sound money.

Our financial system feels…fragile.

We see persistent debasement eroding our savings, debt levels reaching astronomical heights, and a growing sense that the system benefits insiders at the expense of everyone else.

In other words, The Cantillon Effect is real:

These aren’t just temporary issues; they are long term symptoms of a deep, structural problem with the very foundation of our money.

In a lot of ways, they are features structurally woven into the current fiat system.

To understand Bitcoin’s value, we won’t start with complex code or speculative charts.

We will start by asking a fundamental question: What is money, and why is ours broken?

Money is a Technology

Money is simply a tool.

Its nature is being a ledger for keeping track of who owns what.

Its purpose is being a facilitator of trade.

Its ideal state is one that is most “salable” i.e. one that best holds its value across the dimensions of space, time, and scale.

Its state can be measured across its properties of divisibility, portability, durability, fungibility, verifiability, scarcity, and utility.

Regarding its nature , there have been two ledger types over the millennia:

Commodity Ledgers (e.g., Gold): Governed by the laws of nature.

Credit Ledgers (e.g., The Dollar): Governed by the promises of humans.

For a deeper dive into What is Money, checkout the deeper dive below:

Let us explore how the best money is the most “salable” good i.e. the one that best holds its value across the dimensions of space, time, and scale.

Across Space

The monetary medium’s ability to be easily transported over distances.

It must pack a lot of value into a small weight and size.

This is why Rai stones were extremely poor in this regard. The largest stones never moved at all; ownership was simply transferred by public announcement, a system that could only work on a small island where everyone knew one another.

Gold, being dense and valuable, is highly salable across space. A small coin could represent a significant amount of purchasing power, making it easy to carry for trade across empires and continents.

Across Time

The monetary medium’s ability to hold its value into the future.

For an asset to be a reliable store of value, it must be durable and, most importantly, scarce.

This is why apples or fish make poor money—they rot and lose all value quickly.

Gold, being chemically inert and virtually indestructible, excels in this regard; almost all the gold ever mined still exists today.

Across Scale

The monetary medium’s ability to be conveniently divided into smaller units or grouped into larger ones to match the value of any good or service being traded.

This is why Cattle are a poor money because you cannot buy something of little value by paying with a fraction of a live cow.

Gold and Silver are excellent because they can be melted and minted into standardized coins of various weights and denominations, or combined into larger bars.

Historically, silver was often used for smaller, everyday transactions, while gold was used for larger purchases, creating a bimetallic system that covered all scales of trade.

The invention of paper money backed by gold further solved this problem, allowing a single monetary asset (gold) to facilitate payments of any size.

The Historical Winner

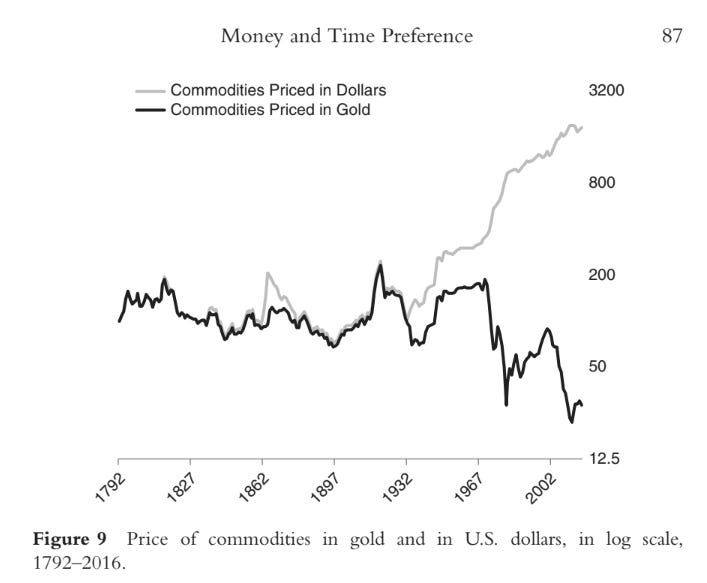

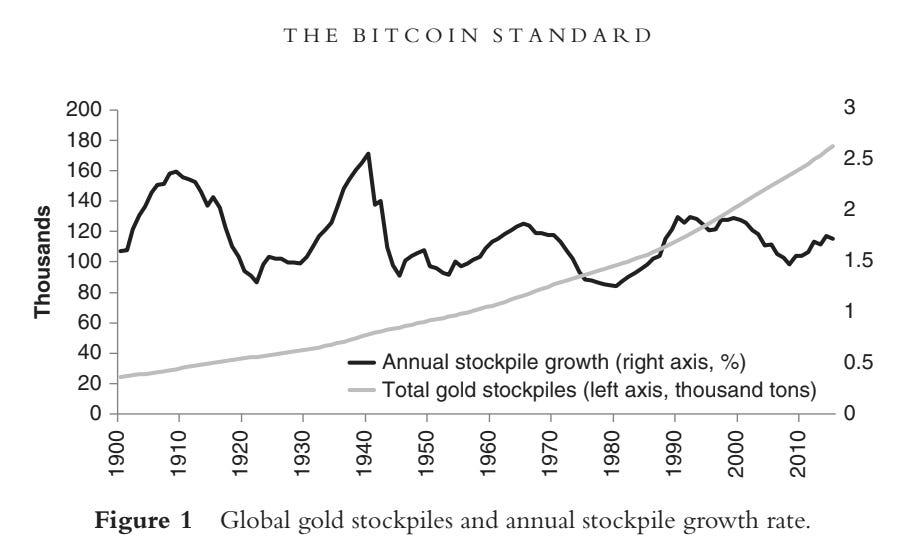

In regards to the time dimension, the key to holding value is having a high stock-to-flow ratio—a large existing supply (stock) relative to new production (flow).

History is a graveyard of monies that failed this test.

Shells, beads, and even giant Rai stones served as money until new technology made them easy to produce, destroying their scarcity and the wealth of those who held them.

This is the easy money trap: anything easily produced AND used as a store of value will see its production increase, and if its supply can be easily increased, it will destroy the wealth of its holders.

Gold won this technological war because it is chemically stable (all the gold ever mined still exists) and geologically rare, giving it the highest stock-to-flow ratio of any physical commodity.

Its supply has reliably grown at only ~1.5% per year, making it resistant to debasement.

What Broke Our Money?

If gold was so effective, what broke our money?

It was a technological mismatch that emerged in the 19th century.

The latter half of the 19th century, a period known as La Belle Époque in Europe and the Gilded Age in the United States, was one of the greatest eras for human innovation and prosperity, and it occurred under a hard money regime: the international gold standard.

Because money held its value or even appreciated, it incentivizing saving and long-term investment.

This vast accumulation of capital financed a wave of world-changing inventions, including electricity, the internal combustion engine, the automobile, and telecommunications (telephone/telegraph).

With a stable monetary unit uniting most of the global economy, international trade flourished, and capital was allocated to productive ends, creating an explosion of productivity and improving living standards worldwide.

With the invention of the telegraph, the speed of transactions (sending information about a payment) became nearly the speed of light.

However, the speed of final settlement in the underlying monetary medium itself (physically moving and verifying gold) remained stuck at the speed of ships and trains.

The speed of information transfer vastly exceeded the speed of physical transfer.

This speed gap created an inescapable arbitrage opportunity and irresistible temptation for centralized intermediaries.

To move value quickly, people had to trust banks with their gold and trade paper claims instead.

This centralization of gold as the monetary medium is an understandable solution to this logistical problem (mismatch in transaction speed vs settlement speed).

This centralization combined with government price controls on gold (a fixed exchange rate i.e. a government declared price that is defined as X units of national currency per unit of gold) instead of a gold price determined by the free market were fatal flaws in the international gold standard.

This design gave governments the power to sever the link to gold and create money through political decree (fiat), which they all did, culminating with the end of the Bretton Woods system in 1971.

Thus, we were left with a fiat monetary system—a credit ledger controlled by government fiat.

This system suffers from two critical weaknesses:

1. Systemic Debasement

Without the anchor of scarcity, governments have always succumbed to the temptation of expanding the money supply to finance spending without direct taxation.

Remember, if the Sovereign wants to increase/change spending for whatever reason the choices are some combination of the following:

Direct Taxation (relatively transparent)

Often unpopular and a last choice of the Sovereign.

Borrowing (relatively transparent)

Often popular and 1st/2nd choice of the Sovereign if Mr. Bond Market permits it.

Creating New Money (relatively opaque)

Often popular and 1st/2nd choice of the Sovereign since it is done opaquely and its downsides are not immediately felt since “no one” is immediately feeling pain.

Spend Less On Something Else (relatively transparent)

Often unpopular and a last choice of the Sovereign since some interest group(s) will lose out on benefits.

This system creates long-term debt cycles where debt builds to unsustainable levels, and the only way out is through high inflation and currency devaluation.

The 2020s are shaping up to be a decade of this type of inflationary deleveraging, similar to the 1940s.

2. Rising Short Term Thinking

Unsound money that constantly loses value discourages saving and encourages debt and instant gratification.

Fiat Enthusiasts would proclaim it incentives investment and production while conveniently ignoring the glaring evidence of the civilization level innovations that occurred in the hard money era of the 19th century.

Why save (or think long term) for a future when your savings are a melting ice cube?

Bitcoin: A Modern Monetary Medium

Bitcoin is a direct competitor to both the the current fiat system and the historical gold standard.

It’s not just an asset; it’s a new kind of monetary network.

It’s a Decentralized Ledger

Bitcoin is more similar to a commodity ledger in that it is governed by nature thru the means of mathematics and energy (proof-of-work).

In other words, it is not a centralized credit ledger that is governed by the promises of people.

Critically, there is no central entity that can arbitrarily change the rules or inflate the supply.

It Achieves Absolute Scarcity

Bitcoin has a fixed supply of 21 million units, hard-coded into the protocol and enforced by a global, decentralized network of users.

It’s the first time humanity has had an asset with absolute, predictable scarcity.

Its stock-to-flow ratio is mathematically destined to surpass gold.

It Closes the Speed Gap

Bitcoin is a scarce, bearer settlement asset that can be transferred anywhere in the world, without a trusted intermediary, at nearly the speed of light.

A bearer asset is a type of financial asset where ownership is determined by physical possession, rather than by registration or the holder’s identity.

It combines the scarcity of gold with the speed of a modern fiat settlement system like Fedwire, and makes it open and accessible to anyone.

An Applied History Case for Bitcoin

Merging these perspectives creates a powerful applied history case for owning Bitcoin.

A Powerful Store of Value

This is the primary case.

In an era defined by systemic currency debasement and unsustainable debt, owning the scarcest liquid asset in human history is a powerful tool for wealth preservation.

It is potentially an anti-fragile asset whose value proposition is strengthened by the very monetary disorder that threatens traditional assets.

It is potentially an ultimate escape from the easy money trap.

An Instrument of Individual Sovereignty

You have ability to hold and move value without permission from any government or corporation.

For the billions living under authoritarianism or hyperinflation, this is not a abstract benefit—it’s a lifeline.

A decentralized monetary storage and movement system with 99.98%+ uptime for 15+ years is no small feat.

For those in developed nations, it is a powerful check on the ever-expanding surveillance and centralized control of the traditional financial system.

A Potential Neutral Reserve Asset

Bitcoin could potentially be a new, global, and neutral monetary standard.

Its open-source nature allows anyone to build on top of it, creating a permissionless ecosystem for innovation.

The Lightning Network, for example, enables instant, near-free global payments on top of Bitcoin’s secure settlement layer.

This network effect is a powerful driver of long-term value.

Overall

By providing a monetary medium that reliably holds value (it is scarce) and moves value without centralized permission (decentralized) where both the speed and settlement of the scarce asset are matched (digitally native), Bitcoin increases the incentive to save and invest for the long term—the very foundation of capital accumulation and human flourishing.

The current monetary fiat foundation is built on the sands of ever-expanding debt and political promises.

Bitcoin’s foundation is built on the bedrock of verifiable scarcity, mathematical truth, and individual sovereignty.

Owning Bitcoin is light years away from pure speculation.

In fact, it is a most prudent decision as seen thru an applied history framework that illuminates it as a substantial advancement in the technology that is money.

I don’t believe we shall ever have a good money again before we take the thing out of the hands of government...all we can do is by some sly roundabout way introduce something that they can’t stop.

-Friedrich Hayek

Disclaimer

This website is not an offer or solicitation in any jurisdiction in which the firm is not registered. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. The services, securities and financial instruments described on this website may not be suitable for you, and not all strategies are appropriate at all times. Investments involve risk and are not guaranteed. Past performance is not necessarily a guide to future performance. Independent advice should be sought in all cases.

TYME Advisors is a U.S. Securities and Exchange Commission (SEC) Registered Investment Advisor . Registration does not imply a certain level of skill or training. Information about the firm including the Customer Relationship Summary is available on the SEC’s website at www.adviserinfo.sec.gov. Information about our privacy policy is located here.