How We Sail Managed Portfolios

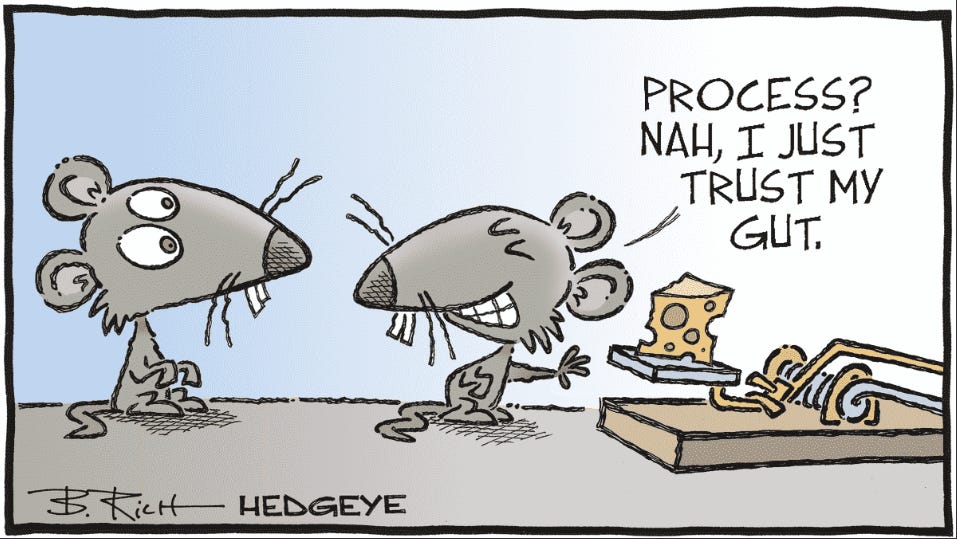

Consider Why The Second Mouse Gets the Cheese

Let us quickly summarize our risk management process for how we sail our managed portfolios.

As a reminder, a long position (the most common type) means you make money when prices rise. A short position (far less common) means you make money when prices fall.

One of the biggest mistakes investors (both pros and amateurs) make is selling winners too soon and bag holding losers too long.

How many of you have stared at your cost basis (deep in the red) and just held the position hoping it comes back to breakeven?

Hope is not a strategy.

Our risk management process is designed to increase the odds we keep winners longer and exit losers sooner while minimizing one’s feelings about any given exposure so that staying calm and rational is easier for the commander, the crew, and the passengers.

In the simplest sense, we have two completely different risk assessment models that operate at very different altitudes of analysis:

Top Down Macro Fundamentals (#Macro: High Altitude and Slow Moving)

Bottom Up Quantitative Indicators (#Quant: Low Altitude and Fast Moving)

Green = All Clear

Red = Warning

Risk Scenario A: #Macro Green and #Quant Green

When both the #Macro and the #Quant say green, then consider adding a long position or buying more of the existing long position up to the maximum size permitted. You are probably correct in your analysis and possibly more right than you realize.

Risk Scenario B: #Macro Green and #Quant Red

When the #Macro says green but the #Quant says red, then don’t enter a long position. If you have an existing long position then exit (perhaps you started in Scenario A but it degraded to Scenario B). The macro weather might be changing adversely before the #Macro detects it. Additionally, you might be mistaken in your #Macro analysis and the #Quant is detecting adverse developments.

Risk Scenario C: #Macro Red and #Quant Green

When the #Macro says red but the #Quant says green, then consider adding a long position but make it a minimum position. The weather might be changing favorably before the #Macro detects it. If the #Macro eventually concurs and says green, then increase the long position to levels fit for Scenario A. Conversely, if the #Quant then degrades and says red then exit as the weather conditions are likely transitioning to Scenario D.

Risk Scenario D: #Macro Red and #Quant Red

When the #Macro says red and the #Quant says red, then don’t take a long position. If you have an existing position then exit the entire position.

Summary

Effectively, the #Quant model serves as a “thesis validation check” because the input into the #Quant’s risk models are critically NOT from your own perspective.

It helps you exit losers sooner (or avoid buying into a loser) which is most valuable when YOU do not understand why the position is performing poorly.

It also helps you stick with winners longer (or avoid selling a winner too soon) which is also valuable when YOU do not understand why the position is performing so well.

Just because YOU don’t understand something does not mean it is therefore a mystery for EVERYONE else.

For some, their process attempts to buy the bottom akin to the axiom “the early bird gets the worm”.

Of course, no one talks about the cost of buying too early (it wasn’t the bottom that you thought it was) akin to the hawk preying upon the too eager early bird.

For us, the nature of our process means we will not likely buy the bottom but we also don’t ride the position to the bottom. In other words, we are not the first mouse.

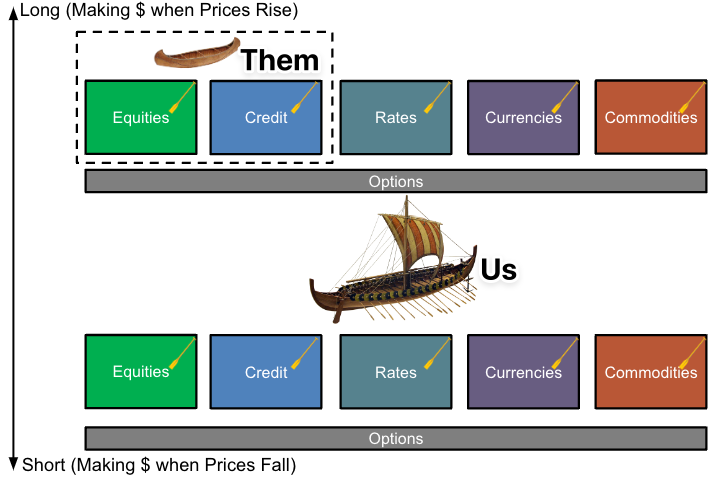

Finally, most other investors/allocators are only able and willing to express their investment positions (however they determine WHAT TO DO) in some combination of long equities and credit which is akin to a canoe with only two oars.

We on the other hand can go long or short across equities, credit, rates, currencies, and commodities along with options for all of the aforementioned.

Disclaimer

This website is not an offer or solicitation in any jurisdiction in which the firm is not registered. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. The services, securities and financial instruments described on this website may not be suitable for you, and not all strategies are appropriate at all times. Investments involve risk and are not guaranteed. Past performance is not necessarily a guide to future performance. Independent advice should be sought in all cases.

TYME Advisors is a U.S. Securities and Exchange Commission (SEC) Registered Investment Advisor . Registration does not imply a certain level of skill or training. Information about the firm including the Customer Relationship Summary is available on the SEC’s website at www.adviserinfo.sec.gov. Information about our privacy policy is located here.