Japan

Why Now?

The top down and longer term positive attributes that we see include:

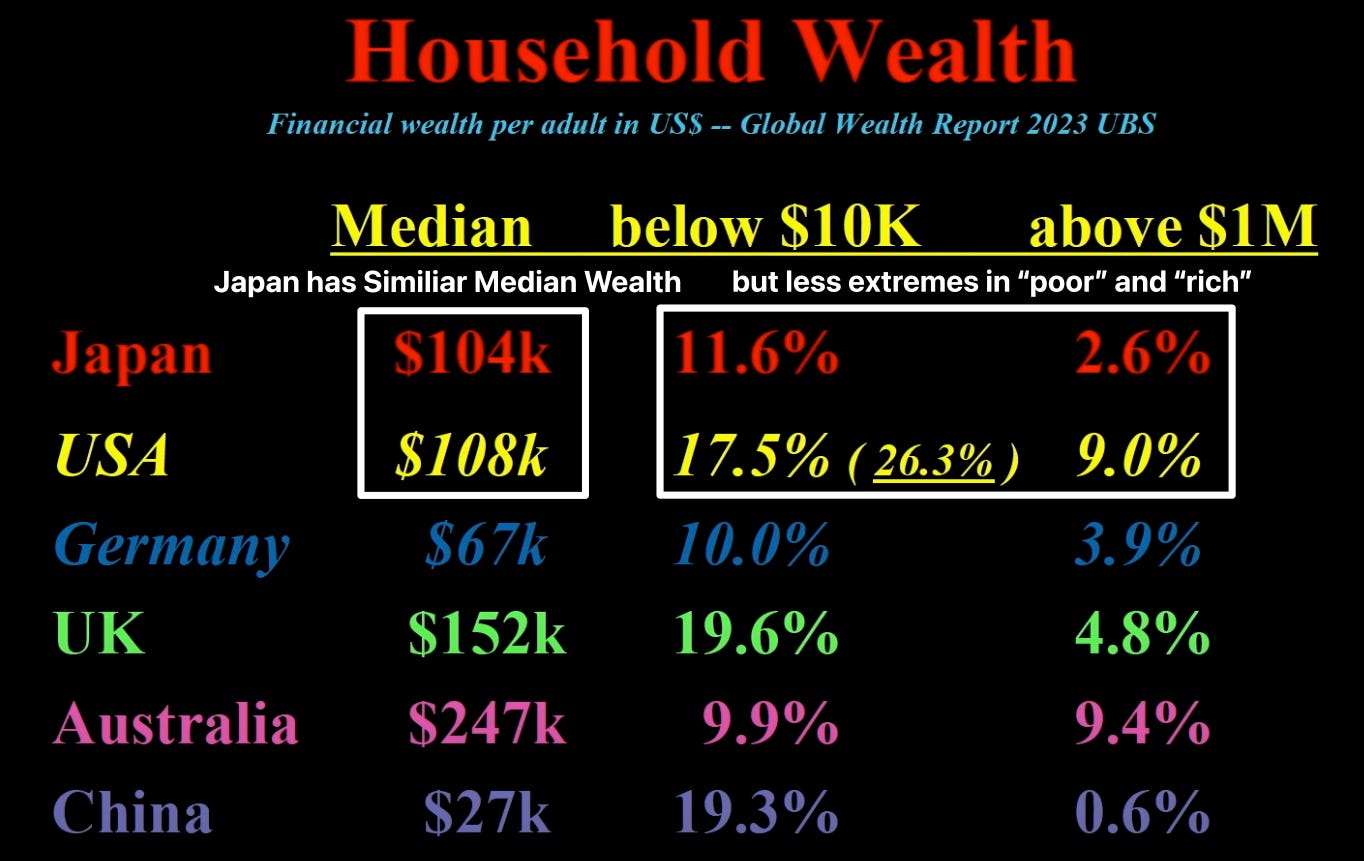

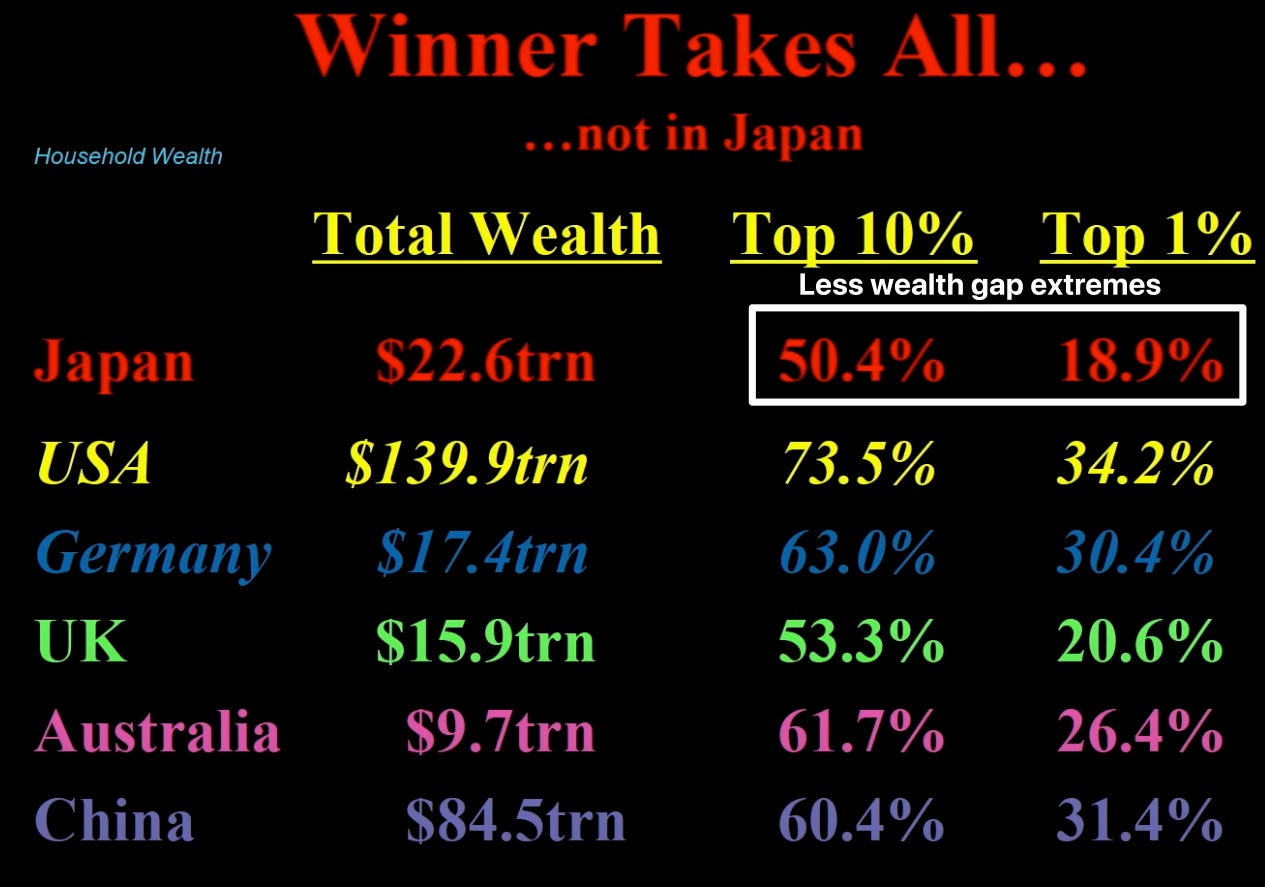

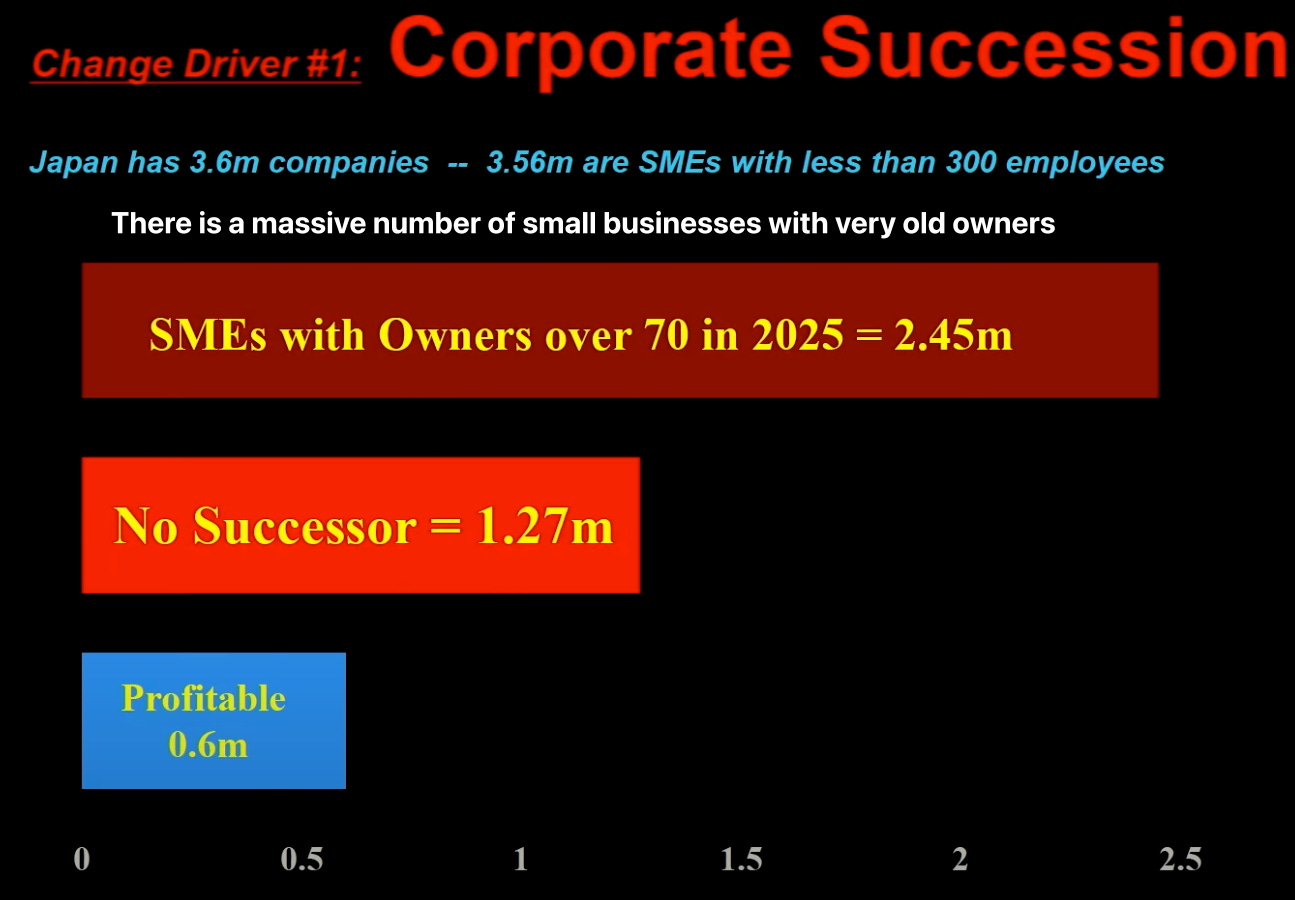

Demographic Shifts and Wealth Transfer

We expect a significant wealth transfer as Japan’s older generation passes on their savings to younger generations. This transfer, amounting to approximately $5-$6 trillion, is anticipated to boost domestic demand and economic activity as younger generations inherit and spend this wealth.

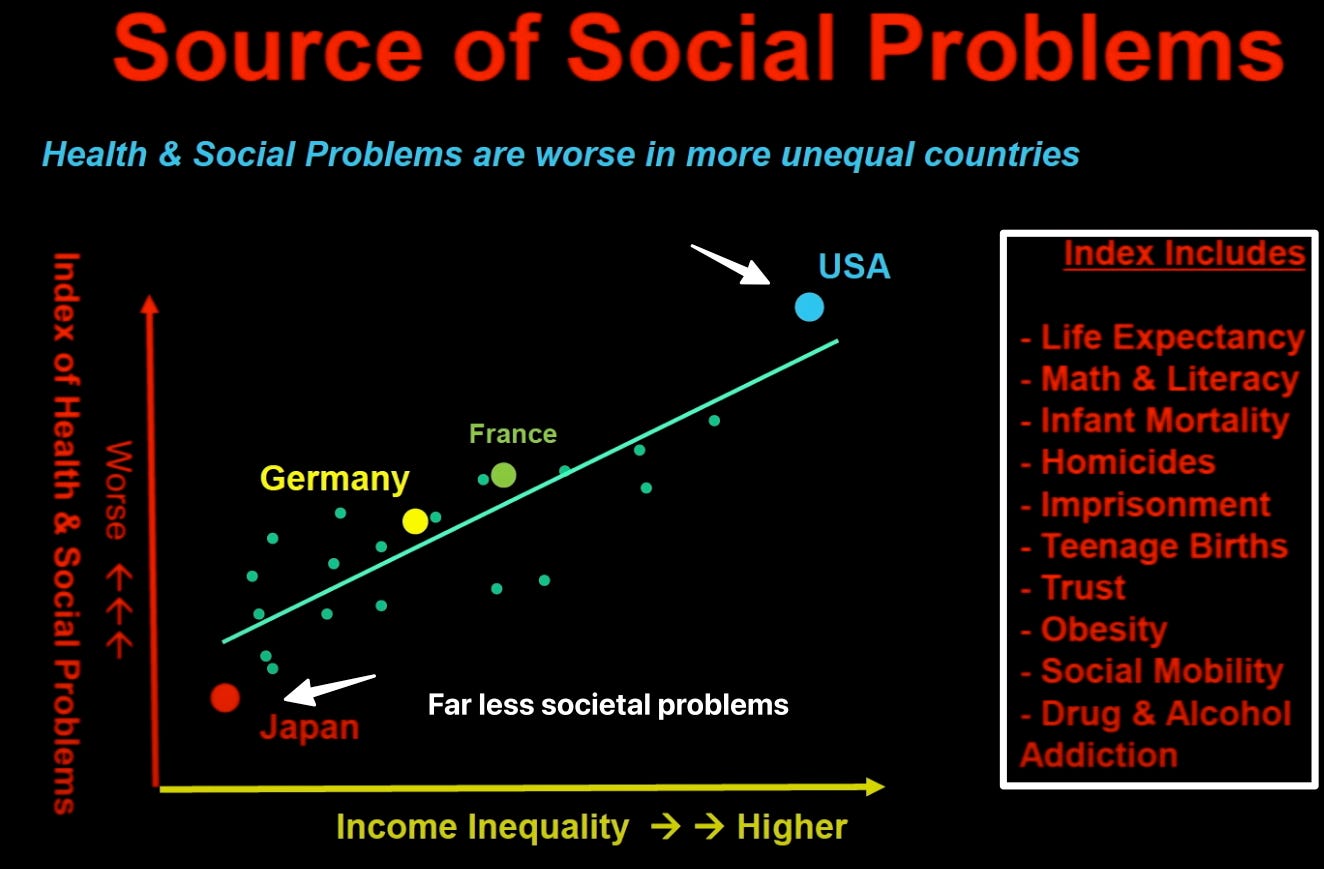

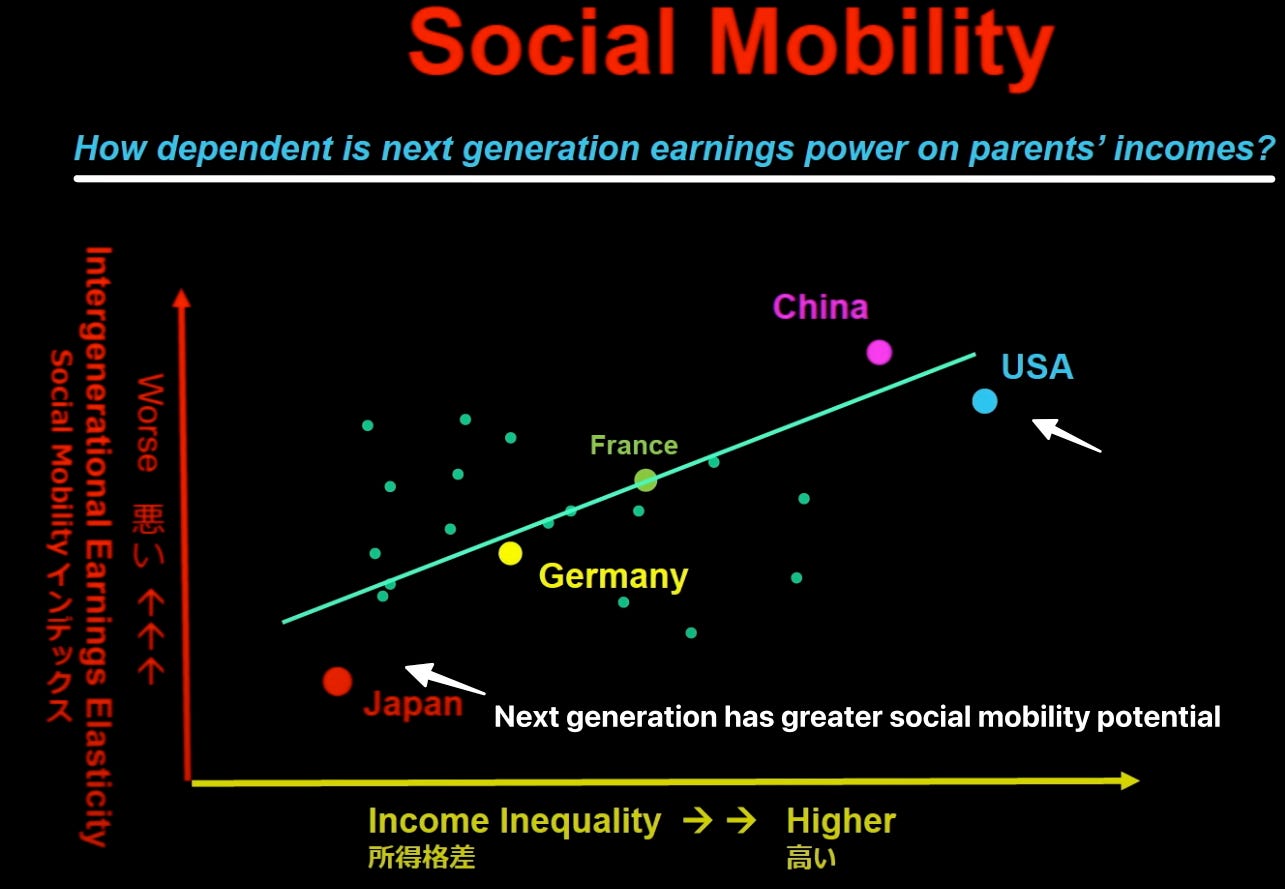

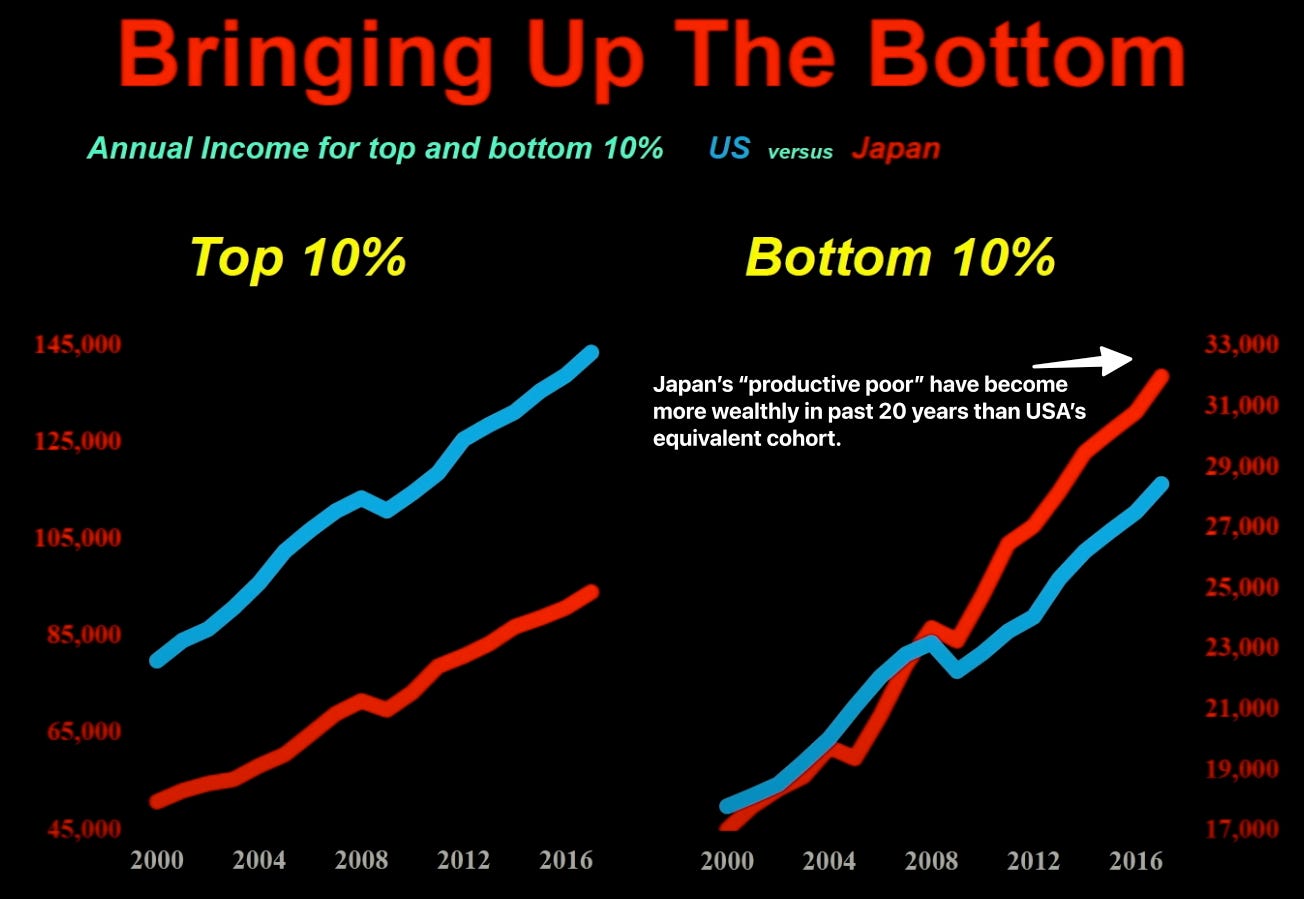

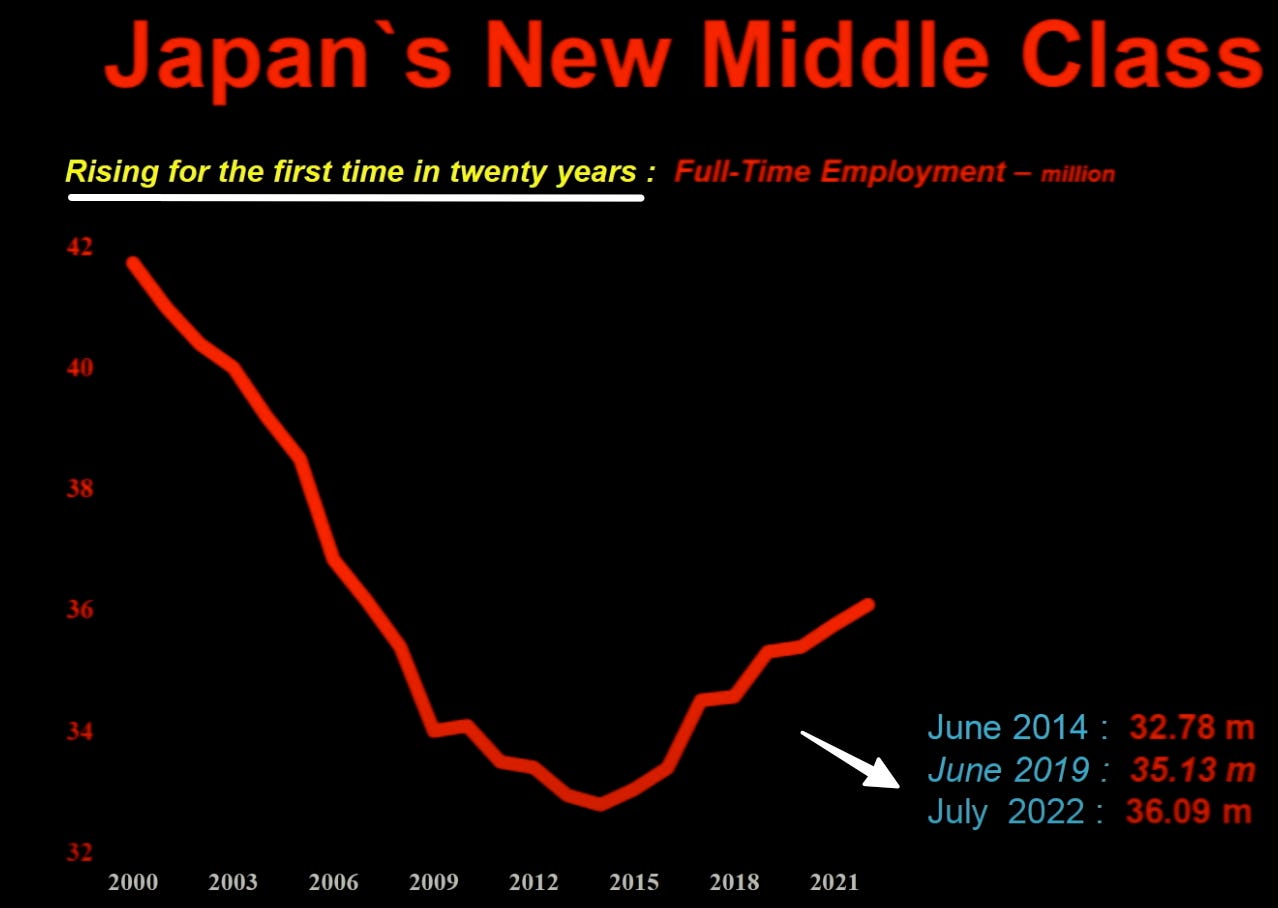

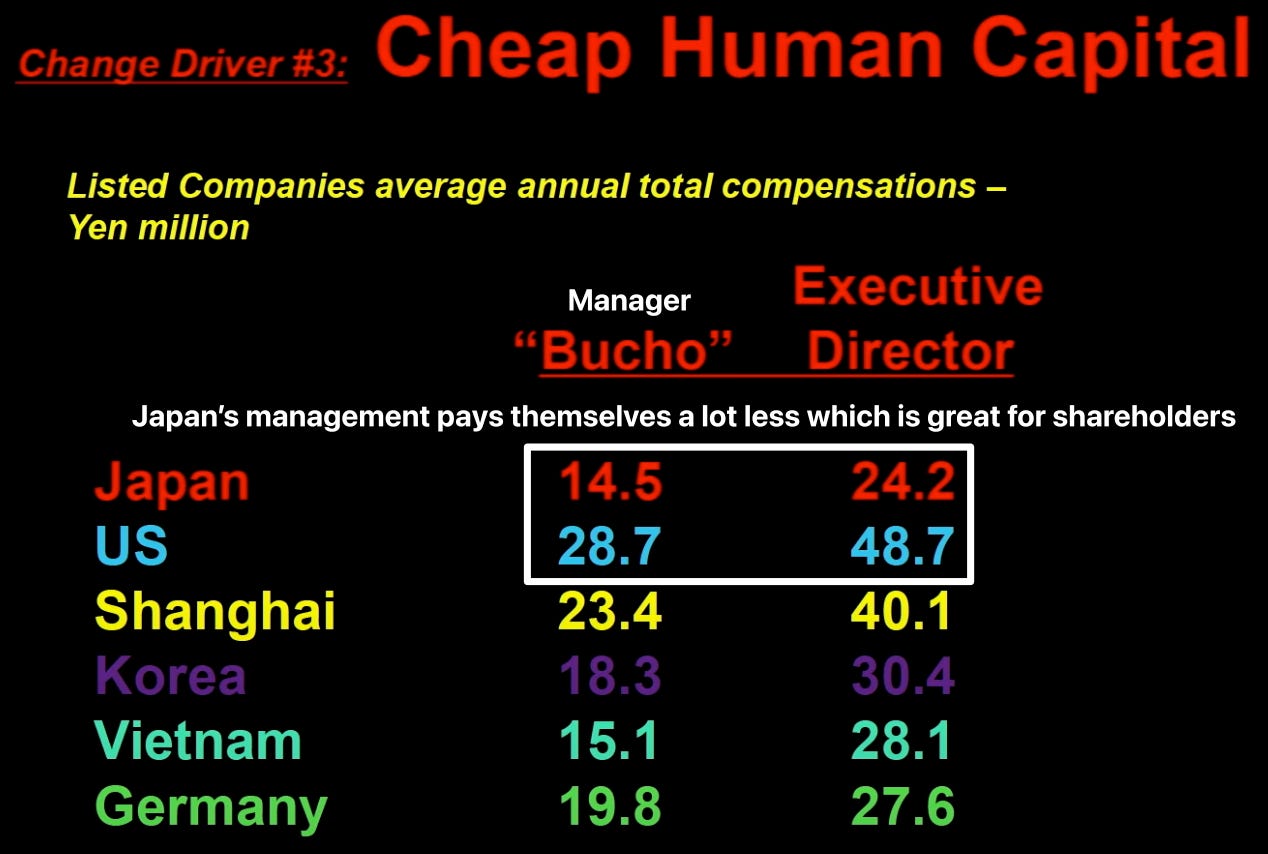

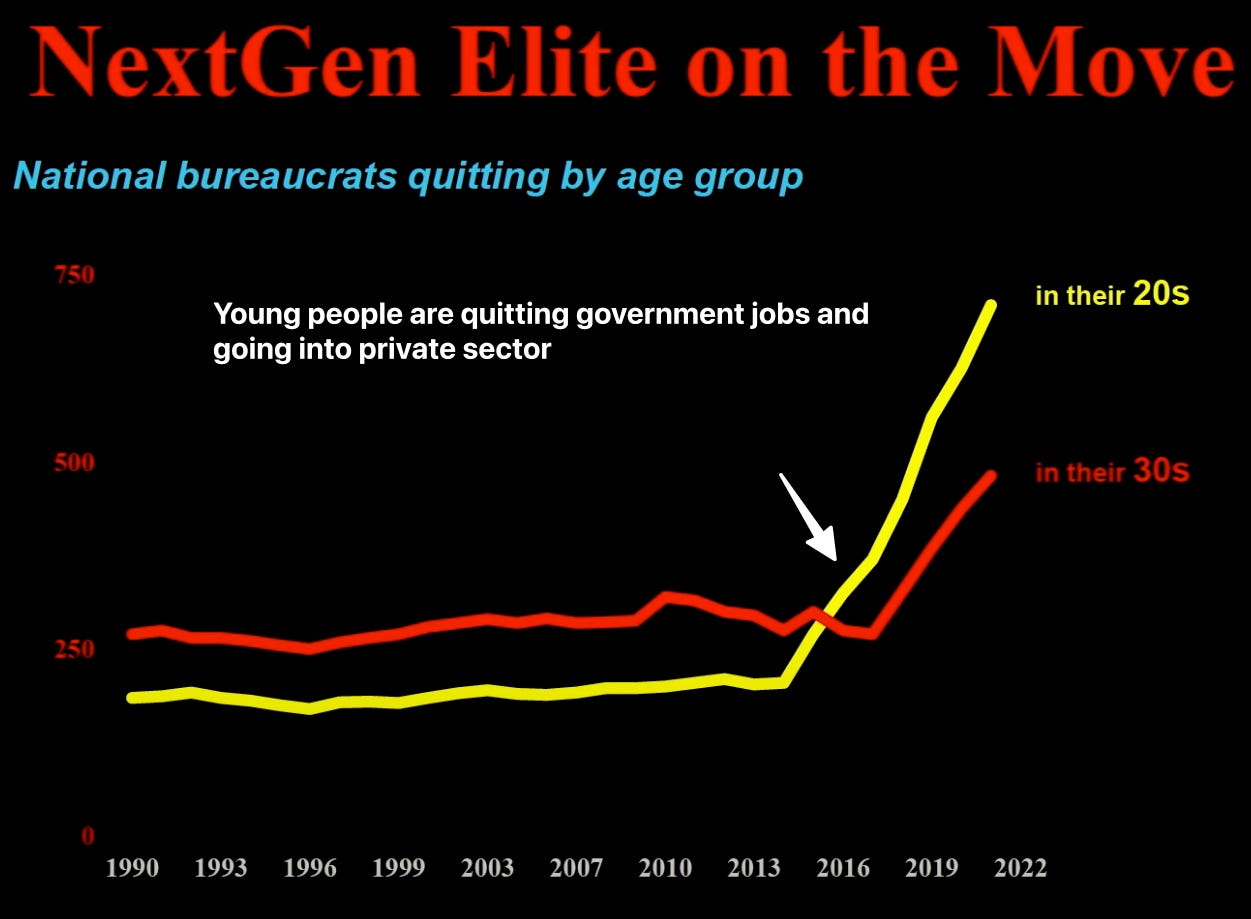

Labor Market Changes

The shift from seniority-based to merit-based pay is transforming Japan’s labor market. As the war for talent intensifies, companies are increasingly offering better pay and career opportunities to attract and retain employees. This shift is expected to enhance productivity and increase incomes, further stimulating domestic demand.

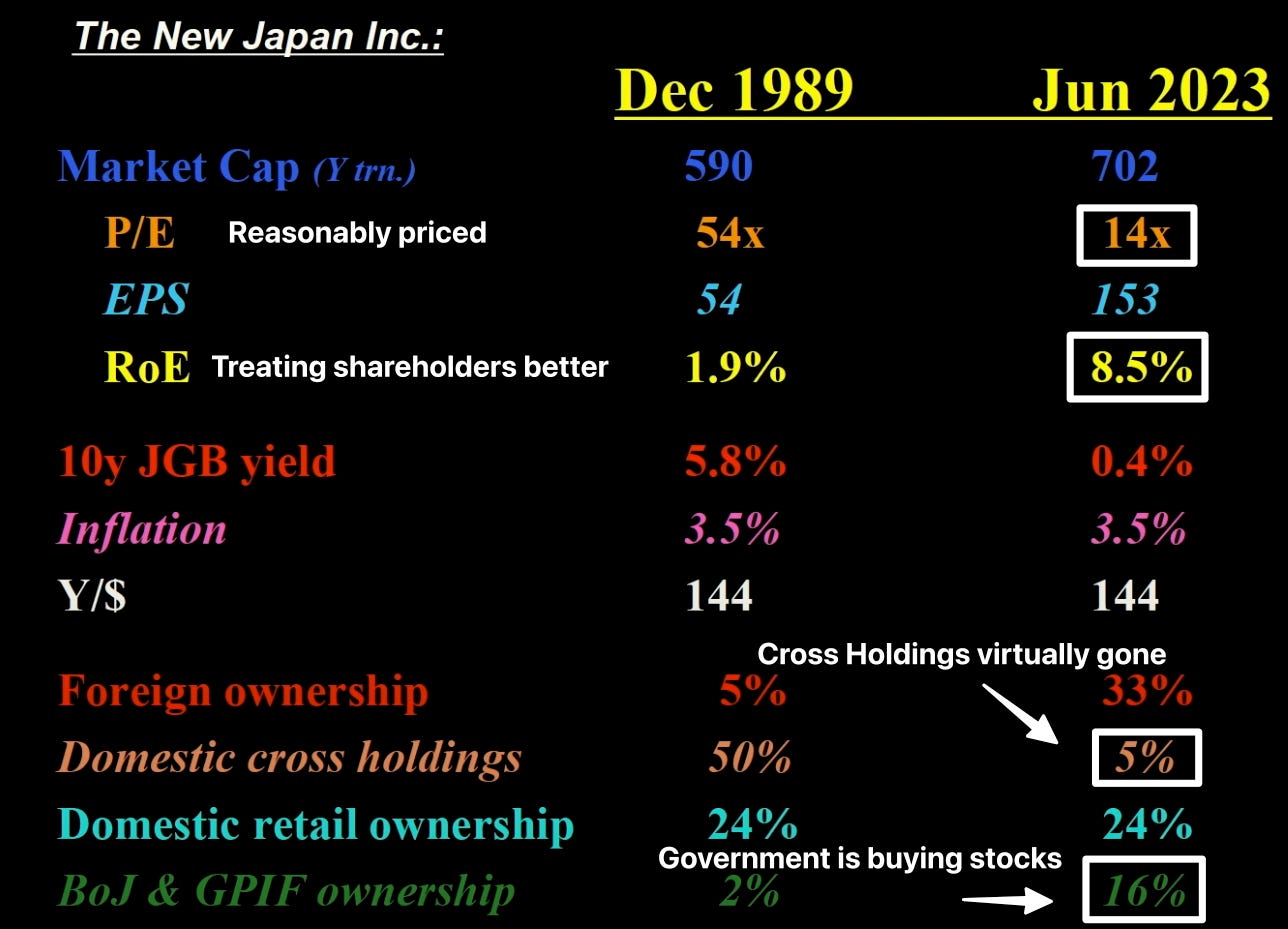

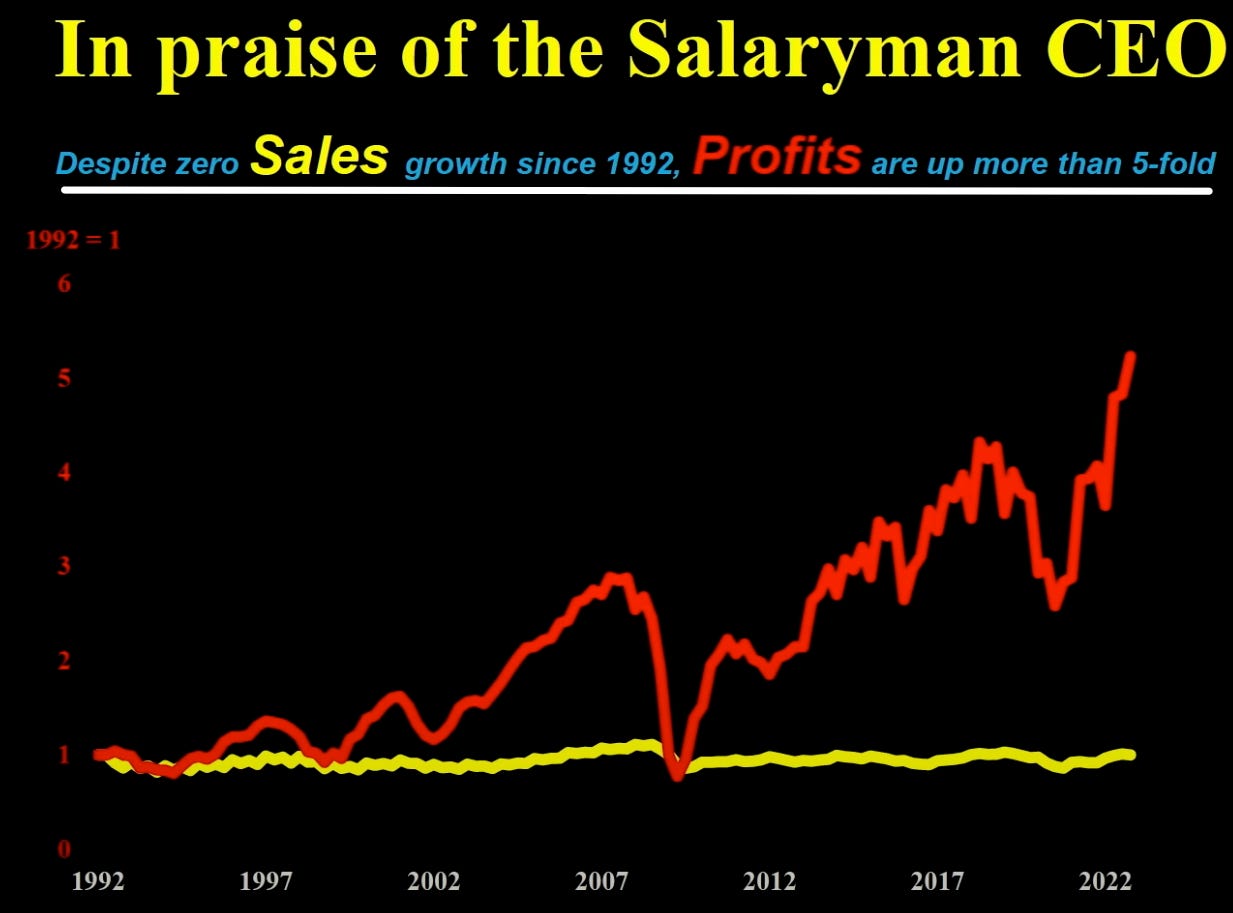

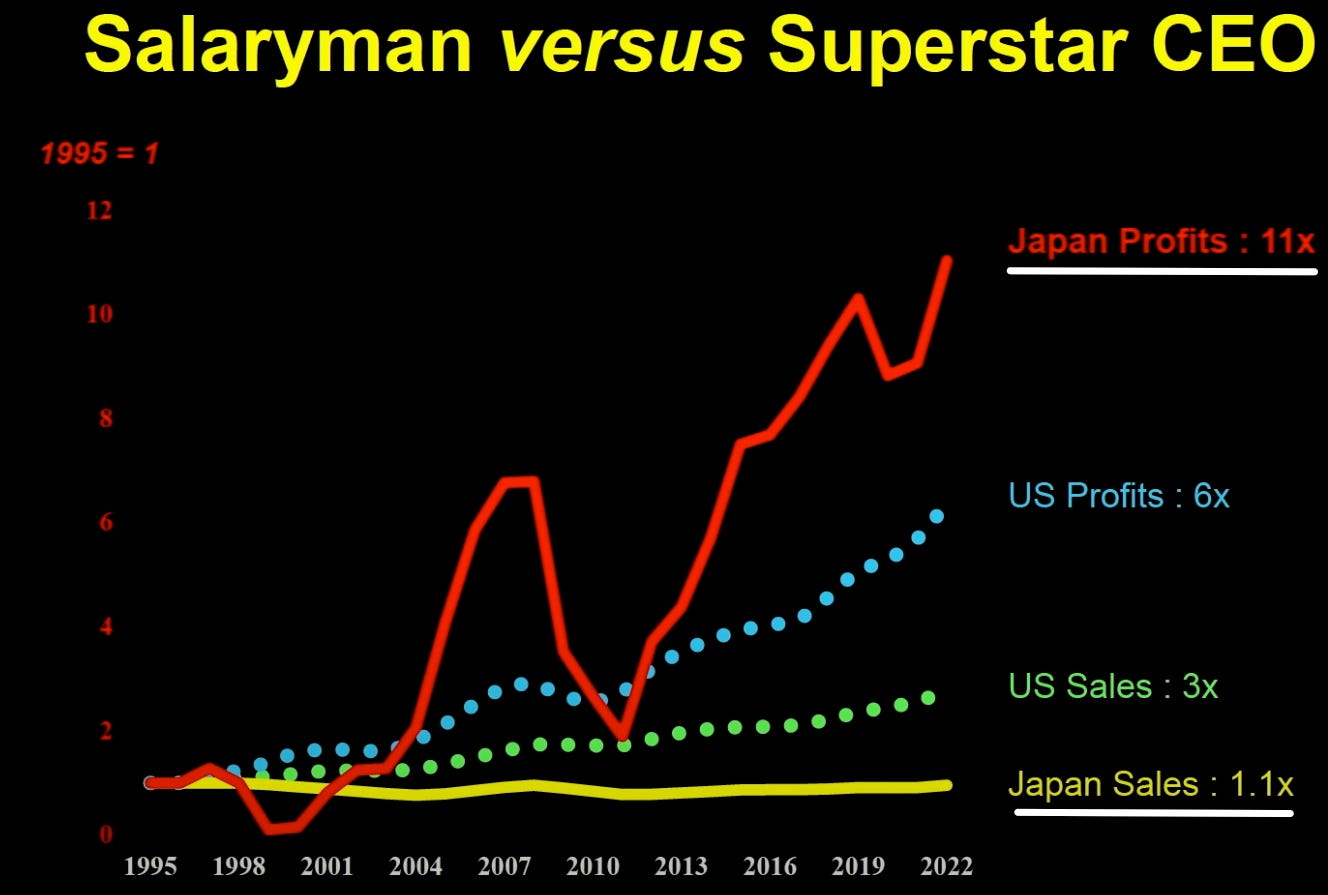

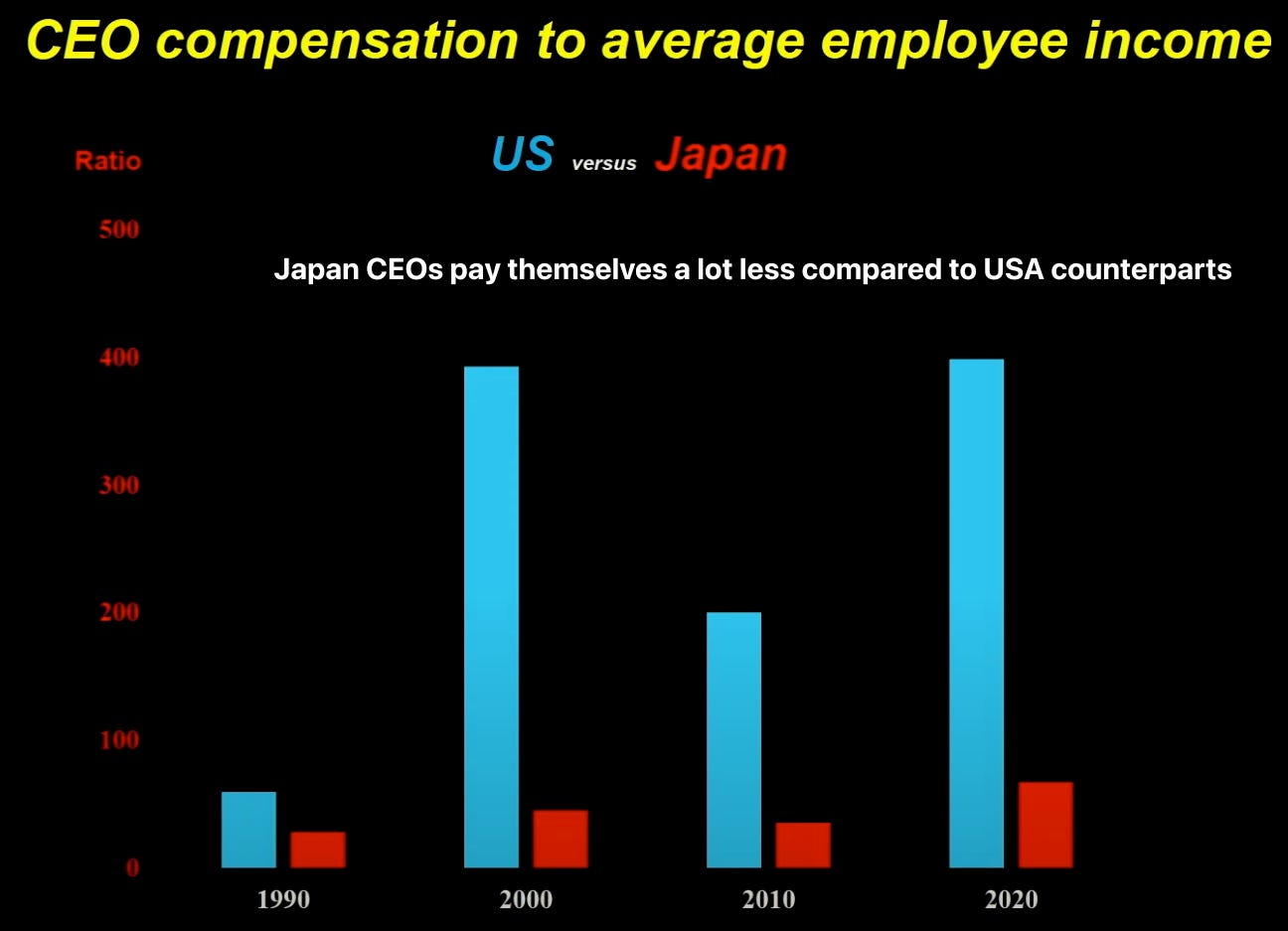

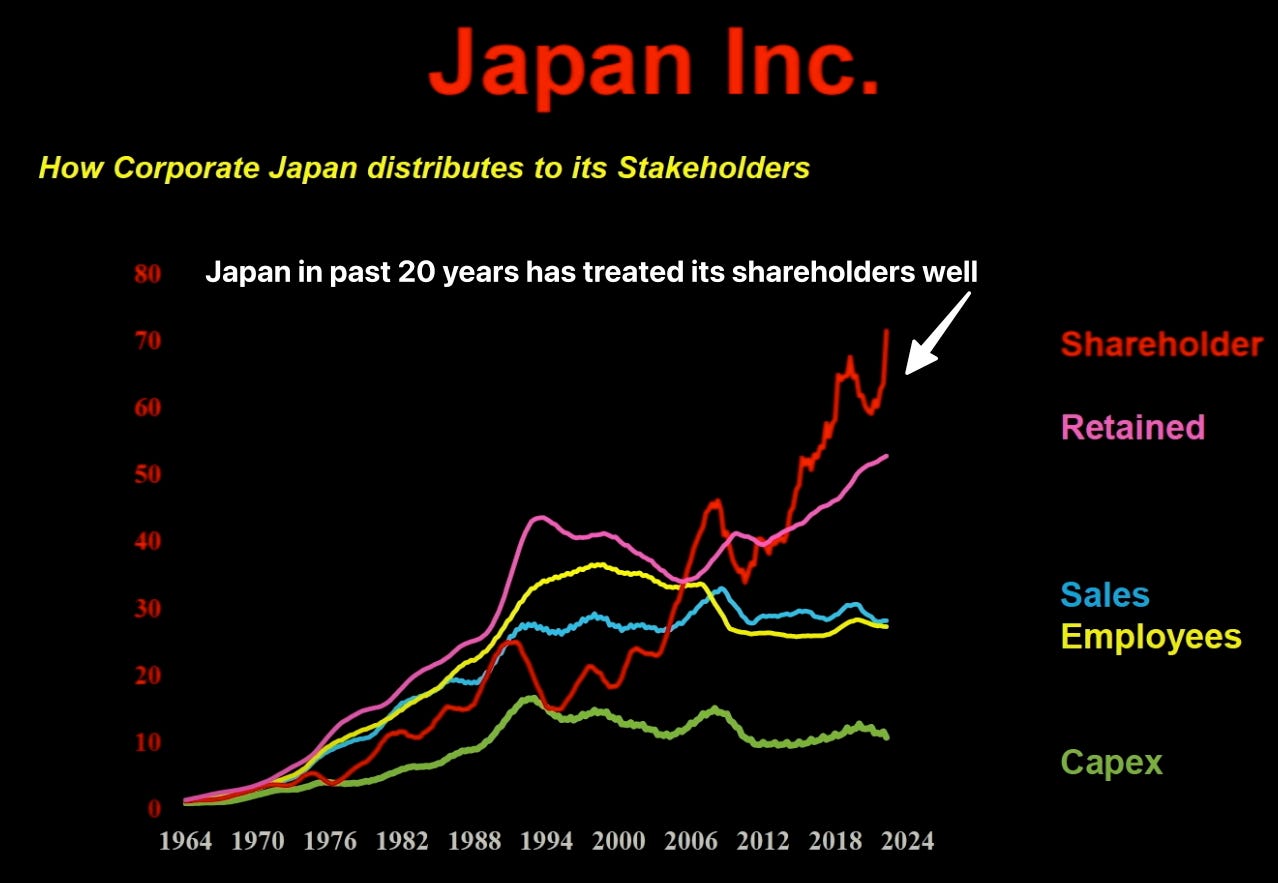

Corporate Efficiency and Profitability

Japanese companies, especially under the leadership of so-called “salaryman CEOs,” have demonstrated remarkable efficiency and profitability. Despite stagnant top-line sales since the mid-1990s, these companies have managed to significantly increase profits. This indicates strong internal management and cost-cutting capabilities, positioning them well for future growth when combined with potential new investments in technology and human capital.

These factors among many more collectively create a compelling case for the continued growth and potential of Japan’s equities.

Source: Jesper Koll, UBS Global Wealth Report 2023, Wilkinson & Pickett & The Equality Trust, OECD, Bank of Japan, US Federal Reserve, Japan Labor Force Survey, Tokyo Stock Exchange, Bloomberg, Census Bureau, METI, Ministry of Finance, Milken Institute

Disclaimer

This website is not an offer or solicitation in any jurisdiction in which the firm is not registered. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. The services, securities and financial instruments described on this website may not be suitable for you, and not all strategies are appropriate at all times. Investments involve risk and are not guaranteed. Past performance is not necessarily a guide to future performance. Independent advice should be sought in all cases.

TYME Advisors is a U.S. Securities and Exchange Commission (SEC) Registered Investment Advisor . Registration does not imply a certain level of skill or training. Information about the firm including the Customer Relationship Summary is available on the SEC’s website at www.adviserinfo.sec.gov. Information about our privacy policy is located here.