Your Tax Loss Harvesting is Broken

Here's How to Fix It.

The Problem

For the taxable investor, after-tax returns are the only returns that matter.

A common tool for minimizing the tax drag headwind is tax-loss harvesting (TLH).

TLH means selling investments at a loss so that those realized losses can offset realized gains.

Since realized gains cause tax bills, this effectively means you can reduce your tax bill.

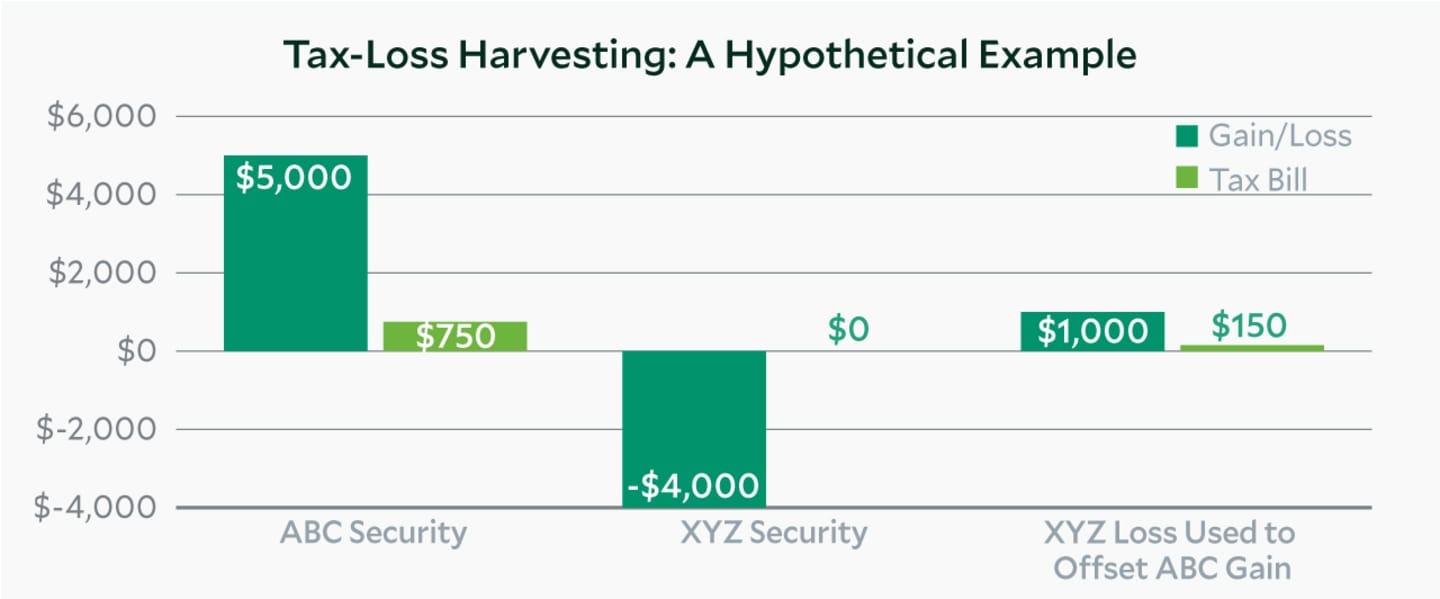

For example:

The hypothetical long-term loss from the sale of XYZ partially offsets the long-term gain from the sale of ABC.

This example assumes a capital gains tax rate of 15 percent. This rate varies by filing status and income.

The offsetting loss results in a tax savings of $600 ($750-$150).

This is effectively tax loss harvesting 1.0

The concept is simple: sell positions at a loss to offset gains elsewhere.

But there's a fundamental weakness in the traditional, long-only approach to TLH.

The very reason we invest in equities—the fact that they tend to go up over time—becomes its Achilles' heel.

Over time, the number of positions with losses tends toward zero.

Your portfolio becomes "frozen”.

Furthermore, the portfolio’s diversification can begin to degrade as certain positions that have done really well become an ever larger portion of your portfolio.

Moreover, you are likely still paying fees for a strategy that effectively has no management i.e. no longer trades and is thus frozen because all positions have gains.

Traditionally, this meant you had to make a choice.

Tax Efficiency

Choose tax efficiency (low to no realized gains and thus low to no taxes) while letting go of risk management (letting the portfolio diversification degrade and still paying fees).

Or

Risk Management

Choose risk management (moderate to high realized gains and thus moderate to high taxes) thus preserving diversification but letting go of tax efficiency.

Upgrading TLH 1.0

A traditional long only TLH 1.0 approach is akin to a canoe with a single oar.

Over time, the single oar is frozen from being used since all remaining positions have gains and thus an active risk manager is frozen out from rowing anymore. The canoe begins to drift aimlessly.

A more robust TLH approach is akin to a longship with multiple oars on both sides.

What are these additional oars?

Shorting

Margin

Going long means making money when prices rise. This is buying low then selling high.

Going short means making money when prices fall. This is selling high then buying low.

By including the ability to use margin along with the ability to go both long and short we now have the means to perform what is called a long/short extension.

This is TLH 2.0

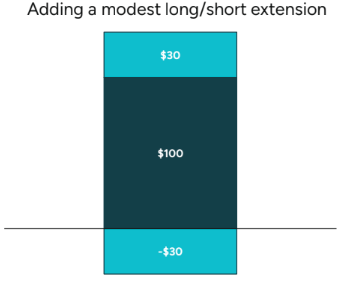

Let us consider an example.

For every $100 of net investment, the portfolio holds $130 in long positions and $30 in short positions for a combined gross exposure of $160.

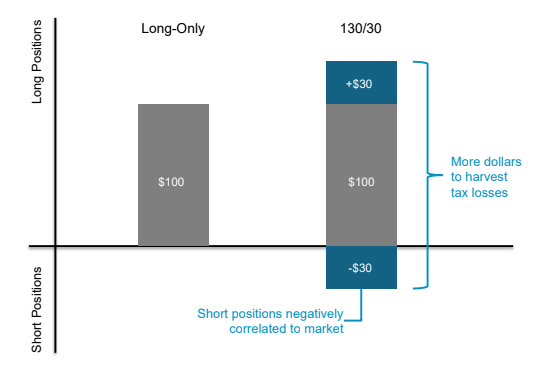

This structure, commonly used by institutional asset managers to enhance returns and control risk, fundamentally addresses the frozen portfolio problem.

Long positions are more likely to generate tax losses when markets decline.

Short positions are more likely to generate tax losses when markets rise. This is something a long only approach cannot do.

This dual oar approach to sailing a taxable portfolio means the strategy can harvest tax losses in virtually any market environment, not just during downturns.

The result is the potential for more significant and consistent tax benefits over time, year after year.

Moreover, by adding margin we literally have more capital at work to harvest tax losses on both sides of the portfolio (long and short).

In the previous example:

the long only approach had $100 at work.

the long short extension approach had $160 at work.

Tighter Risk Management

Adding margin and shorts might sound like it ratchets up the risk, but this structure is designed with risk management at its core.

In the previous example, the net exposure remains 100% (130% long - 30% short), with a goal of maintaining similar levels of return and risk relative to the market.

The portfolio construction process is risk-controlled, using tracking error targets and controlled industry exposures to stay aligned with the market.

This is essentially like using lane keeping assistance technology to keep your car (the portfolio) within the desired lane (the market).

Potential Active Stock Selection Value Add

Moreover, outperformance may be had thru the active stock selection process.

Let us look at a simplified example.

ABC company

Market Benchmark Weight is 1%

Portfolio Weight is 2%

XYZ company

Market Benchmark Weight is 1%

Portfolio Weight is 0%

If ABC company outperforms XYZ company this means additional performance has been earned because there was an overweight to the company that relatively outperformed.

This is further magnified because there is more money at work since we have $160 gross exposure in this long short approach versus the $100 at work in a long only approach.

More importantly, the upgrade of TLH 1.0 to TLH 2.0 does not require compromising on the original point of the portfolio’s purpose which in this example was to maintain equity market exposure.

Use Cases

TLH 2.0 is a powerful tax planning solution for a range of use cases.

1. Thaw "Frozen" Taxable Accounts

Many investors have long-only taxable accounts that have stopped generating meaningful tax benefits, have degraded diversification, and continue to incur management fees. By adding a long/short extension:

The account can "thaw" its frozen ability to generate consistent tax benefits.

The account can “thaw” its frozen ability to maintain diversification.

2. Thaw “Frozen” Concentrated Stock Positions

If a large part of your net worth is tied up in a single, highly-appreciated stock, selling it could trigger a massive tax liability.

This approach can specifically address this problem.

The concentrated stock is used as collateral to build a diversified long/short extension around it. Upon deploying the extension, the portfolio’s diversification is materially improved. Then, losses consistently generated by this extension are then used to offset the gains realized from selling down the concentrated stock over time.

This allows for a gradual, tax-neutral transition into a diversified portfolio. The long/short extension adds immediate diversification which helps reduce the concentrated stock risk during the concentrated stock’s divestiture period.

3. Prepare for a Future Capital Gain Event

Business owners or investors anticipating a large, future capital gain—such as from the sale of a business or other major asset—face a substantial future tax bill from that single event.

The long/short extension can be used proactively in the years leading up to the sale to accumulate tax losses.

When the realized capital gain event occurs, these accumulated tax losses can be used to offset this large capital gain, potentially saving a significant amount in taxes and preserving more of the hard-earned proceeds from the sale.

TLH 2.0

The evolution from long only TLH 1.0 to a more robust long/short TLH 2.0 represents a significant leap forward for taxable investors.

By embracing a structure that can generate tax alpha regardless of market direction, investors can pursue more effective compounding of after-tax wealth.

It is a compelling solution that rejects the false binary choice of either tax efficiency or risk management into one that is both while simultaneously enhancing the efficiency and effectiveness of a financial plan.

Disclaimer

This website is not an offer or solicitation in any jurisdiction in which the firm is not registered. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. The services, securities and financial instruments described on this website may not be suitable for you, and not all strategies are appropriate at all times. Investments involve risk and are not guaranteed. Past performance is not necessarily a guide to future performance. Independent advice should be sought in all cases.

TYME Advisors is a U.S. Securities and Exchange Commission (SEC) Registered Investment Advisor . Registration does not imply a certain level of skill or training. Information about the firm including the Customer Relationship Summary is available on the SEC’s website at www.adviserinfo.sec.gov. Information about our privacy policy is located here.